federal income tax definition

Federal income taxes are. Federal Unemployment FUTA Tax.

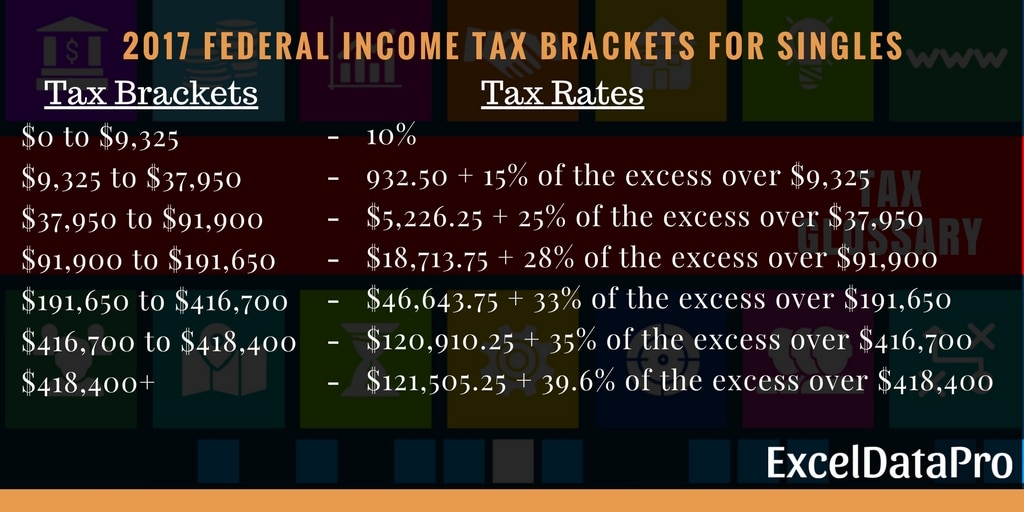

Federal Income Tax Brackets For The Year 2017 Exceldatapro

The federal income tax is the tax levied by the Internal Revenue Service IRS on the annual earnings of individuals corporations trusts and other legal entities.

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

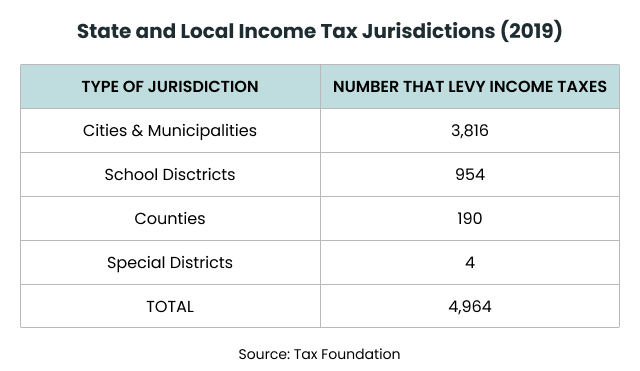

. Define Federal income tax. Income taxes are levied by the federal government and by a number of state and local governments. LITC services are offered for free or a small fee.

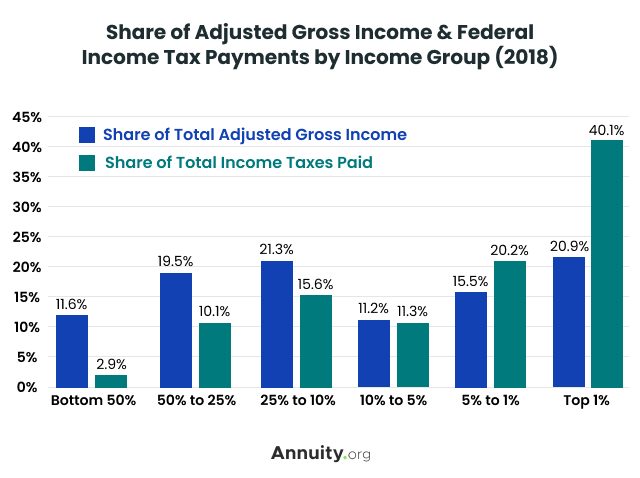

The Federal Insurance Contributions Act FICA is a US. Income taxes are levied by the federal government and by a number of state and local governments. Gross income can be generally defined as all income from whatever source derived a more complete definition is found in.

One set of rules. A tax levied on the annual earnings of an individual or a corporation. Businesses employers must follow the IRS.

Employers report and pay FUTA tax separately from Federal Income tax and social security and Medicare taxes. Income tax is a tax that governments impose on income generated by businesses and individuals within their jurisdiction. Up to 16 cash back Federal income tax is a tax on income and is imposed by the US.

Some terms are essential in understanding income tax law. Federal income tax synonyms Federal income tax pronunciation Federal income tax translation English dictionary definition of Federal income tax. A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments.

The federal income tax is levied by the Internal Revenue Service on individual and corporate income to pay for government services. The IRS collects federal income taxes and enforces federal tax law in the United States. In the case of any transfer of property subject to gift tax made before March 4 1981 for purposes of subtitle A of the Internal Revenue Code of 1986 formerly IRC.

A tax on an individuals net income after deductions for various expenses and payments such as charitable gifts calculated on a formula which takes into consideration. Federal Income Tax means any Tax imposed by Subtitle A of the Code and any interest penalties additions to tax or additional amounts in respect of the foregoing. Income can come from a job.

One set of rules. A tax levied on the annual earnings of an individual or a corporation. The IRS collects the tax.

It manages and oversees the complex set of tax regulations created by the federal tax code. For more information or to find an LITC near you visit Low Income Taxpayer Clinics or download IRS Publication 4134 Low. Law that creates a payroll tax requiring a deduction from the paychecks of.

Federal Insurance Contributions Act - FICA.

How Are Payroll Taxes Different From Personal Income Taxes

Are Gift Cards Taxable Taxation Examples More

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

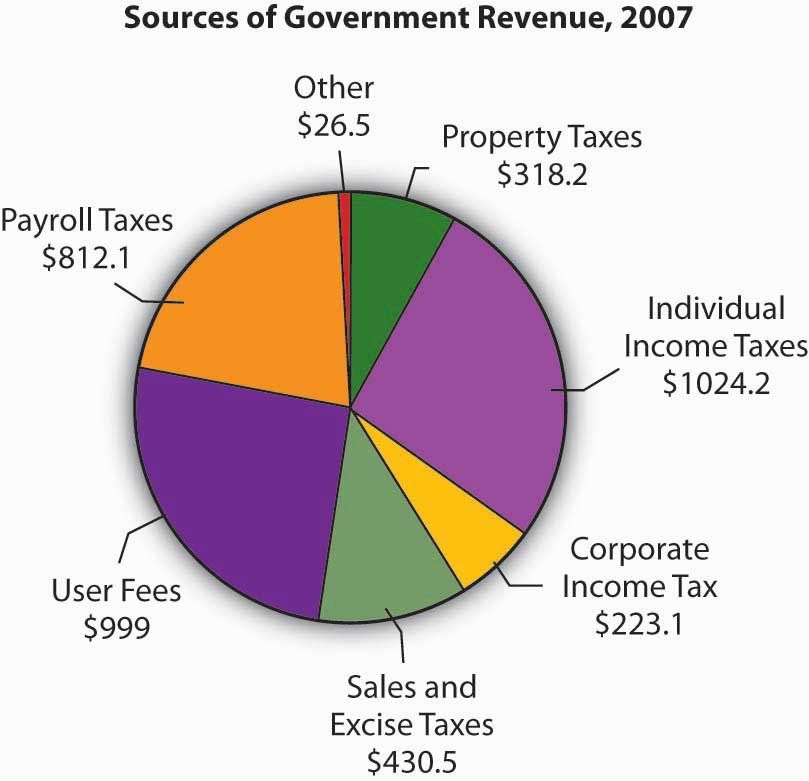

15 2 Financing Government Principles Of Economics

Income Tax Definition What Are Income Taxes How Do They Work

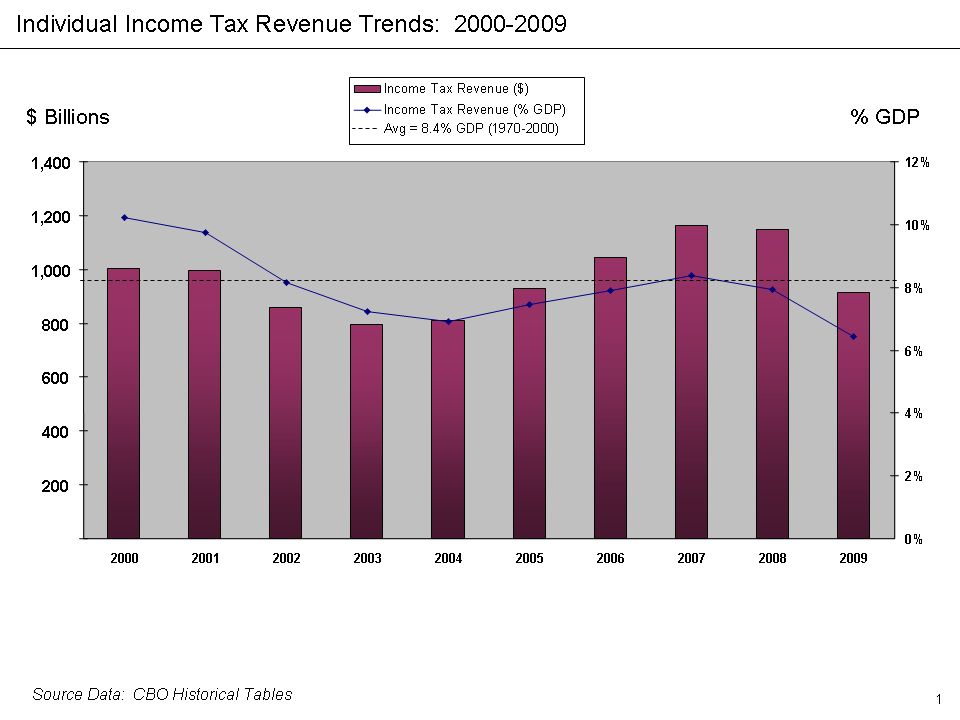

File Federal Individual Income Tax Receipts 2000 2009 Png Wikimedia Commons

Oc Fed Income Tax Brackets Breakdown R Dataisbeautiful

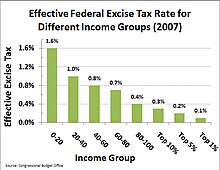

Excise Tax In The United States Wikipedia

The Purpose And History Of Income Taxes St Louis Fed

Taxation In The United States Wikipedia

Income Tax History Tax Code And Definitions United States

Income Tax In The United States Wikipedia

What Are The Major Federal Excise Taxes And How Much Money Do They Raise Tax Policy Center

Income Tax Definition What Are Income Taxes How Do They Work

Federal Income Tax Withholding Employer Guidelines And More

Income Tax History Tax Code And Definitions United States

/FederalincometaxGettyImages-64622606223-3d13d816e3094066894f0d4fd13c2e51.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Net_of_Tax_Dec_2020-98efd407350341fdb178949dadd84c5c.jpg)